Denied or Underpaid: The Dilemma Texas Property Owners Face

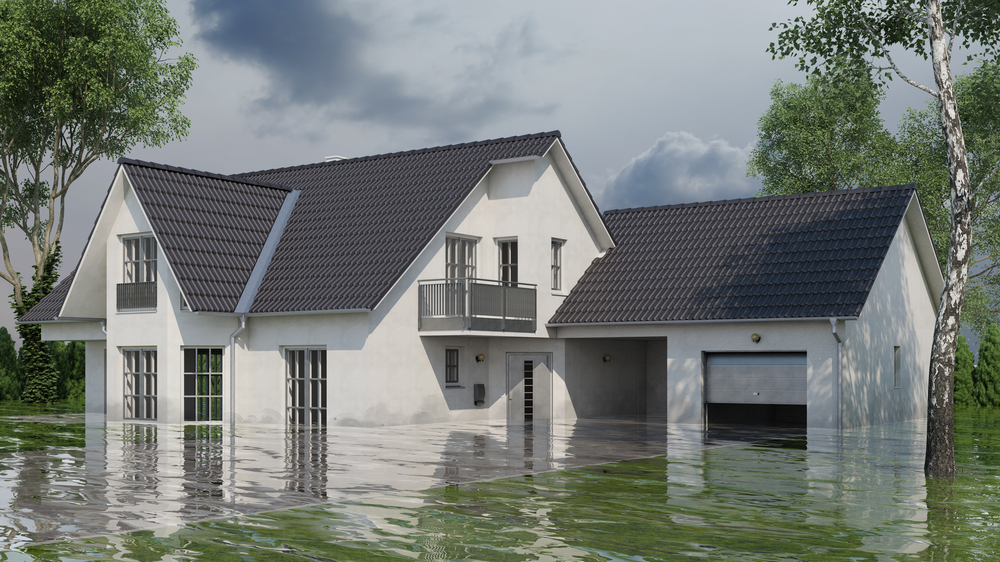

Imagine a Texas homeowner watching a summer hailstorm batter their roof, or a driver seeing their car crumpled after a collision. You expect insurance to step in and make things right. Yet many Texans face a harsh reality: their property damage claims come back denied or drastically underpaid. It’s frustrating and overwhelming. If you’re in this situation, you’re not alone – and it’s not your fault. Insurance companies often put profits first, leaving honest people with damaged homes or vehicles wondering whether to keep fighting the insurance claim or to take legal action. This article will walk you through that tough choice with empathy and clear guidance. We’ll explore how Texas property damage law protects you, what obstacles you might encounter with insurers, and when bringing in a lawyer might be the best move for your family.

At JCE Law Group, we’re here to support you through every step—not to pressure you, but to make sure you understand your legal rights and feel confident moving forward. If you have questions, we offer a free, no-obligation consultation. Call our team today at 504-754-5884.

Navigating Texas Property Damage Law Made Simple

Texas property damage law might sound complex, but its core goal is simple: to ensure you’re treated fairly when you file a claim. Texas laws and regulations spell out the duties of insurance companies and the rights of policyholders. For example, the Texas Insurance Code requires insurers to handle claims in good faith and within set timeframes. If an insurance company unreasonably delays or denies a valid claim, they can face penalties such as having to pay your attorney fees and even extra damages in court. Texas law also forbids “unfair settlement practices,” meaning insurers can’t, for instance, refuse to pay without a reasonable investigation or fail to explain why they denied your claim.

Common challenges: Despite these laws, Texas policyholders often struggle with insurance companies. It’s common to hit roadblocks like endless requests for more documentation, lowball settlement offers that don’t cover repair costs, or outright denials citing obscure policy exclusions. Insurers have teams of adjusters and lawyers; they might hope you’ll give up or accept less than you’re owed. This is where understanding your rights under Texas property damage law becomes critical. It empowers you to push back and seek help if needed.

Timeline of a Property Damage Claim in Texas

Getting a fair payout requires some patience and persistence. Here’s a quick look at how the insurance claim process should go under Texas law:

-

File Your Claim Promptly: As soon as damage happens (be it a burst pipe or a fender-bender), notify your insurance company. They must acknowledge your claim within 15 days of receiving notice in writing. This means an adjuster should contact you and start the process within about two weeks. (After major disasters, this could take a bit longer, but they still owe you prompt communication.)

-

Investigation Phase: The insurer will investigate the damage. You’ll need to provide documentation – photos, repair estimates, police reports, etc. Once you’ve submitted all requested info, the company has 15 business days to make a decision on your claim. During this time, they may send an adjuster to inspect the property. Cooperate and provide any additional info promptly to keep things moving.

-

Approval or Denial: By the end of that period, the insurer should either approve (fully or partially) or deny your claim in writing. If they deny any part of it, they must give a clear reason. If they approve the claim, Texas law says payment must follow quickly – the insurer has 5 business days after approval to send your check. This is meant to get funds in your hands so you can start repairs or replacements without undue delay.

-

Extensions & Delays: In special cases, an insurer can request more time (for example, if a hailstorm caused thousands of claims at once, making investigations harder). They have to send you a written explanation and then can take up to 45 additional days to decide. But they can’t drag their feet indefinitely. A company that takes too long without good reason could be “acting in bad faith” under the law. In fact, if you sue and win against an insurer for unjust delays, they might owe you 18% annual interest on your claim amount as a penalty, plus your legal fees.

-

Legal Deadlines: Keep in mind, if it reaches the point where you consider filing a lawsuit (either against the insurance company for a denied claim or against a third party who caused your property damage), there is a statute of limitations. In Texas, you generally have two years from the date of the property damage to file a lawsuit seeking compensation. This deadline, set by Texas Civil Practice & Remedies Code §16.003, applies to most property damage cases (whether it’s damage to your house or your car). Missing this window usually means losing your right to sue, so don’t wait until the last minute if you’re heading down the legal path.

Understanding these timelines and rights is key. They give you a roadmap and also a way to hold the insurance company accountable. If the insurer isn’t following the rules – say, ignoring you for weeks or denying your claim without a valid reason – Texas property damage law gives you tools to respond. You can file a complaint with the Texas Department of Insurance (TDI) to put pressure on the insurer, or ultimately, you can pursue a legal claim for bad faith or breach of contract. In short, the law tries to level the playing field, but sometimes you might still need to take further action to get what you’re owed.

Insurance Payout vs. Lawsuit: Weighing Your Options for Resolution

Once you’ve navigated the initial claim process, you’ll reach a crossroads: Should you accept what the insurance offers, keep negotiating, or pursue legal action? The right path depends on your situation:

-

Successful Insurance Claim: The ideal outcome is that your insurer does the right thing – they pay the full cost to repair your home or car (minus any deductible) and you move on. Many claims do get paid fairly, especially when they’re straightforward and well-documented. If you got a fair payout that covers your damage, legal action might not be necessary. Just be sure the settlement truly covers all your losses (property repairs, personal belongings, etc.) before you sign off.

-

Insurance Claim Problems: Unfortunately, some claims don’t end so smoothly. Perhaps the insurance company is only offering half of what it will actually cost to rebuild your patio, or they denied your roof leak claim citing “wear and tear.” In these cases, you still have options within the insurance process: you can appeal the decision internally, submit additional evidence or contractor estimates, or even request an independent appraisal if your policy allows. If those efforts fail, that’s when turning to legal action becomes a consideration.

-

Legal Action (Lawsuit or Demand Letter): Filing a lawsuit is a big step, but it can be the right one if you’ve been wronged. In Texas, if an insurance company is acting in bad faith or violating insurance laws, suing can not only get you the money to fix your property, but potentially additional damages. Sometimes, even the threat of a lawsuit (for example, a strongly worded demand letter from an attorney) can make a stubborn insurer come back to the negotiating table. Legal action can also be aimed at a third party instead of your insurer – for instance, suing a negligent driver’s insurance (or the driver personally) if they wrecked your car and their insurer won’t pay enough. Keep in mind that lawsuits take time and evidence, so it’s usually wise to consult with a lawyer to evaluate the strength of your case first.

So, how do you decide which path is right? Start by asking these questions: Is the insurance company offering a fair amount based on repair estimates and market values? Are they cooperating and communicating, or stonewalling you? How large are your losses – can you afford to cover the gap if the insurer underpays, or is it tens of thousands of dollars you shouldn’t have to absorb? Also, consider timing: if months have passed with no resolution, the legal route might be necessary to break the stalemate. The good news is, Texas law is on your side when insurers misbehave, and courts can hold them accountable to the full value of your claim plus penalties in some cases.

Why JCE Law Group is the Best Choice for Texas Property Damage Claims

Choosing to involve an attorney is a significant decision. If you reach that point, you want someone who not only knows Texas property damage law but also genuinely cares about your outcome. This is where JCE Law Group comes in. We’re proud to be advocates for Texas residents who are tired of getting the runaround from insurance companies. Our team has extensive experience with property damage claims of all types – from negotiating large homeowner’s insurance claims after hailstorms to fighting for drivers whose vehicles were totaled by reckless drivers. We understand the tactics insurers use in Texas, and we know how to counter them effectively and professionally.

At JCE Law Group, our approach is personal. We start by listening to your story and reviewing the details of your claim or case. Then we give you an honest assessment of your options – whether it’s pushing the insurer for a better settlement or filing a lawsuit to get justice. Our track record speaks for itself: we’ve helped clients recover the funds they needed to rebuild their lives. We also handle the hard stuff so you don’t have to deal with stressful communications or legal filings. When you have a dedicated property damage claims attorney on your side, the balance of power shifts in your favor. Insurers take your claim more seriously because they know you mean business and that you have the law on your side. Our goal is to relieve your burden, fight for your rights, and ultimately make sure you’re made whole. In short, JCE Law Group strives to be the ally you need when you’re facing one of life’s toughest challenges – recovering from major property damage.

The Real Impact: More Than Just Property Loss

Texas weather and traffic don’t just create statistics – they change lives. When a storm rips the roof off your house or an accident lands your car in the shop, the economic and emotional impact can be devastating. On the financial side, you might be dealing with expenses well beyond what you anticipated. For example, if a hurricane damages your home, you could face repair bills for structural damage, replacing personal belongings, and maybe paying for a hotel or rental if your home is unlivable. These costs add up fast, and insurance payouts sometimes fall short. In fact, Texas sees more property damage than most states due to our unique exposure to natural disasters. Texas is hit by nearly every form of severe weather – hurricanes, hail, tornadoes, floods, wildfires – you name it. Since 1980, Texas has experienced 172 weather disasters that each caused over $1 billion in damage, more than any other state. Just recently in 2023, a single North Texas hailstorm caused an estimated $7–$10 billion in losses. Those numbers aren’t just data; they represent thousands of families picking up the pieces.

Emotionally, the toll can be even heavier. Your home isn’t just wood and brick – it’s where memories are made. Losing or damaging it hurts on a personal level. The same goes for your vehicle if it’s essential for your work or family life. Stress, anxiety, and even trauma are common after these events. It’s made worse when an insurance company dismisses your valid claim. Many Texas homeowners know the sinking feeling of seeing a claim denial letter or a tiny check that doesn’t cover half the damage. The stress of financial uncertainty – wondering if you can afford repairs or replace your belongings – can strain relationships and health. We’ve seen elderly couples fearful they’ll lose their longtime home because an insurer delays a roof repair payout, and parents worried about keeping their kids safe in a mold-infested house after a flood. Beyond money, there’s also time and energy lost in dealing with claims: hours on hold with insurance, juggling contractors, filling out forms. All of this is why having a fair resolution to your property damage claim is so important – it’s not just about fixing a structure or a car, it’s about getting your life back on track.

Key Factors That Can Make or Break Your Claim

Every property damage case is unique, but there are some key factors that often determine the outcome of an insurance claim (and any legal follow-up):

-

Type and Cause of Damage: Insurance policies in Texas differ on what they cover. For instance, standard homeowners insurance usually covers wind and hail damage, but flood damage is typically excluded (you’d need a separate flood policy). Similarly, auto policies differentiate between collision damage and comprehensive (non-collision events like hail or theft). The cause of your damage matters – was it a natural disaster, an accident caused by someone else, or gradual wear and tear? Insurers love to label things “wear and tear” or pre-existing damage since that’s not covered. If you can clearly tie the damage to a specific incident or date (like a storm on June 1 or a crash on I-35), you’re in a stronger position under your policy.

-

Documentation and Evidence: One of the biggest factors in getting your claim paid is how well you document your loss. This starts from day one – take photos or videos of all damage, keep receipts for any emergency repairs or hotel stays, and write down a timeline of what happened. If it’s a car accident, get a police report. If it’s a home issue, save any reports from electricians, plumbers, or inspectors. The more evidence you have, the harder it is for an insurer to dispute your claim. In Texas, where storms can damage entire neighborhoods, having before-and-after photos or even local news reports of the event can bolster your case that “Yes, a hailstorm really did shatter all my windows.” Detailed inventories of damaged personal property (for home claims) and repair estimates from reputable contractors or mechanics can counter low estimates from insurance adjusters.

-

Policy Details and Deadlines: Always review your policy to know the coverage limits and requirements. Your insurance contract might have specific duties you must follow – like notifying the insurer within a certain time, protecting the property from further damage (tarp that roof!), or using approved shops for car repairs. Missing a notification deadline or failing to mitigate damage could give the insurer an excuse to deny the claim. Additionally, be aware of legal deadlines: as mentioned, you generally have two years to sue for property damage in Texas, but there may be shorter deadlines to invoke certain policy provisions (for example, some homeowners policies require you to demand an appraisal to dispute the claim amount within 60 days of the insurer’s offer). If in doubt, consult an attorney so you don’t accidentally waive any rights by waiting too long.

-

Insurance Company’s Track Record: Let’s be honest – some insurance companies are just better than others when it comes to handling claims. If you’re with a company known for aggressive cost-cutting, expect a tougher fight. Texas regulators do keep an eye on insurers, and companies can get fined for excessive complaints, but that doesn’t help you in the moment when you’re arguing over a claim. Being polite but firm, and escalating the issue (asking for a supervisor or filing a complaint with TDI), can sometimes move your claim along if the adjuster isn’t cooperating. Insurers know that a knowledgeable consumer who mentions “Texas Insurance Code” or “bad faith” is someone they can’t just ignore. Showing that you know your rights (and are willing to get a property damage claims attorney involved if needed) can make a big difference in the outcome.

By managing these factors – documenting everything, knowing your policy, meeting deadlines, and standing up for your rights – you greatly improve your odds of a fair recovery. And if despite your best efforts the claim is still going nowhere, those same factors (solid evidence, clear timelines, etc.) will strengthen your case if you do seek legal help.

Storm Damage vs. Auto Accident Claims: Not All Property Damage is Equal

Texas residents can suffer property damage from all sorts of events, but two of the most common are severe storms and car accidents. Each scenario comes with its own playbook for claims:

-

Texas Storm Damage (Home or Vehicle): When nature strikes – whether it’s a hailstorm, hurricane, tornado, or wildfire – you’re usually dealing with a first-party insurance claim. That means you’re filing with your own insurance company (homeowners or auto comprehensive, for example). Texas sees more than its fair share of wild weather. In fact, in 2023 Texas had a record 1,123 hail events (the most in the nation), and hail alone caused billions in damage to homes and cars. After a major storm, insurance companies are swamped with claims, which can slow things down, but they are still obligated to treat each claim individually and fairly. A big difference with storm claims is that they might trigger special rules; for instance, after a named hurricane, Texas law allows insurers a bit more time to respond because of the disaster scope. Homeowners should also be wary of “hurricane deductibles,” which are higher out-of-pocket costs that apply only to hurricane damages (check your policy for this). If your car was damaged by a storm (like hail or flood), your auto policy’s comprehensive coverage should kick in; if you only carry liability coverage (which is common for older cars), unfortunately storm damage to your own car wouldn’t be covered by your insurance. Another thing to note: after widespread disasters, unscrupulous contractors sometimes swoop in with scams. Texas consumers should never sign away insurance claim rights to a contractor without consulting a lawyer or ensure they’re dealing with reputable, local licensed contractors.

-

Auto Accident Property Damage: Car crashes bring a different dynamic because Texas is an at-fault state for auto insurance. That means if another driver crashes into you, their liability insurance should pay for your vehicle damage. In practice, you might end up dealing with both third-party and first-party claims. For example, you can file against the at-fault driver’s insurance, but if they delay or if their coverage isn’t enough, you might use your own collision coverage (if you have it) to get your car fixed and let your insurer seek reimbursement. One key difference here: the negotiations often involve determining fault. The other driver’s insurer may try to argue you were partly to blame, which can affect the payout. Texas follows a proportionate responsibility rule – if you’re more than 50% at fault, you can’t recover from the other party, and if you are less, your recovery might be reduced by your percentage of fault. This can complicate property damage claims for accidents (for instance, a messy multi-car pileup). Also, auto insurers have limits – Texas drivers are required to carry at least $25,000 in property damage liability coverage, but if your brand-new truck is totaled, $25k might not cover it. In such cases, you might need to sue the at-fault driver for the remainder or tap into your underinsured motorist coverage (if you purchased that). Handling vehicle damage claims can be frustratingly slow too – getting repair estimates, dealing with adjusters who might insist on used parts, etc. However, the general Texas insurance laws about fair dealing apply here as well. If an insurance company (yours or the other driver’s) is clearly jerking you around – say, not responding within the required time or refusing to pay an amount that even their own repair shop agrees is necessary – you again have the option to involve regulators or take legal action for breach of contract or bad faith. Car property damage cases rarely go to court by themselves (they often accompany injury claims), but you absolutely can sue for vehicle damage alone if needed.

In summary, storm claims are usually you vs. your insurer and hinge on policy coverage (was that peril covered?) and proper valuation of damage, whereas auto accident claims involve fault-finding and possibly another party’s insurer. In both situations, knowing the differences helps: for storms, document everything and beware policy nuances; for accidents, get the crash report, prove fault, and know the insurance limits at play. No matter the cause, if you’re not getting a fair shake, Texas property damage law offers recourse – you just might need to nudge the process with professional help.

When to Consider Hiring a Property Damage Claims Attorney

Most people aren’t eager to get lawyers involved in an insurance claim. It can feel like “escalating” the situation, and you might worry about costs. However, there are certain moments when bringing in a property damage claims attorney is not only justified but likely to significantly improve your outcome. Here are some signs it’s time to at least consult an attorney about your Texas property damage issue:

-

Your Claim Was Wrongfully Denied or Lowballed: If you have a strong claim with clear evidence and the insurer flat-out denies it or offers a token sum that doesn’t come close to the actual damage, that’s a red flag. For instance, say your entire living room was flooded from a burst pipe (a covered peril) and you have photos, but the insurance adjuster cites a technicality to deny it – an attorney can review whether that denial holds water (no pun intended). Often, just having a lawyer point out the Texas Insurance Code provisions the insurer may be violating can prompt a reevaluation of a low offer.

-

Bad Faith Indicators: “Bad faith” is legal-speak for when an insurer isn’t just making an honest mistake, but rather acting without regard for your rights – like ignoring evidence, failing to communicate, or misrepresenting the policy. Texas takes bad faith seriously; if proven, you could get additional damages beyond the policy limits. If you sense your insurer is stringing you along or being dishonest (for example, three different adjusters have handled your claim and none of them return calls, or they suddenly cancel your policy when you file a claim), it’s time to get a lawyer’s perspective.

-

Complex or High-Value Claims: If your property damage is extensive – think a house fire or a multi-car accident – the dollar values and complexities go up. There may be multiple expert reports, contractors, or engineers involved. In such cases, an attorney can coordinate the evidence and negotiations. Moreover, insurance companies tend to fight harder when big money is on the line. Having an experienced advocate can ensure nothing is overlooked (like hidden structural damage or future expenses) and that you’re not bulldozed into a quick, cheap settlement.

-

Legal Deadlines and Next Steps: Perhaps you’re approaching that two-year post-accident mark and the claim still isn’t resolved – you might need to file a lawsuit to preserve your rights. Or maybe you received a settlement offer that comes with a release to sign, and you’re not sure if it’s fair. These are pivotal moments where legal advice is crucial. A property damage attorney will inform you of any statutes of limitation (for example, the 2-year lawsuit deadline) and other legal steps so you don’t accidentally lose your ability to recover. They can also explain the pros and cons of litigation versus continued negotiation.

-

Peace of Mind: Finally, consider hiring an attorney for peace of mind. Dealing with property damage is stressful enough; adding an insurance battle can be downright exhausting. When you hire a lawyer, they handle the communication – those calls and emails go to them, not you. They’ll also formulate the legal strategy, whether it’s demanding appraisal, filing a lawsuit, or negotiating a settlement. This can take a huge weight off your shoulders, letting you focus on getting life back to normal.

Remember, consulting with a property damage claims attorney doesn’t mean you’re committing to a lawsuit. Many offer free consultations. You can get an expert opinion on your case and understand what it might cost. Sometimes, the best outcome is achieved without ever setting foot in a courtroom – a lawyer’s involvement can lead to a fair settlement through talks or mediation. The key is recognizing when you’ve done all you can on your own and it’s time for professional help. In Texas, plenty of attorneys (like our team at JCE Law Group) operate on contingency for these cases – meaning you don’t pay unless you win – so access to legal help is more reachable than you might think.

Lessons from Our Experience

At JCE Law Group, we’ve seen firsthand how tough property damage situations can be, and those experiences shape how we help clients today. In one case, a family’s home in South Texas was severely damaged by a windstorm. The insurance company delayed and then tried to deny the claim, blaming “pre-existing issues.” We got involved, uncovered internal reports that supported the family’s claim, and ultimately the insurer reversed course and paid to rebuild the home. We learned that persistence and solid evidence can turn a ‘no’ into a ‘yes’ – a lesson we apply to every case. In another instance, a client’s business property was vandalized and the claim was lowballed. Our team pressed the insurer by invoking Texas laws on unfair practices and, just before trial, negotiated a settlement over triple the original offer. These experiences taught us the value of early legal intervention. By stepping in early, we often resolve disputes more quickly and favorably, saving clients months (or years) of waiting. We carry these lessons with us: no matter how complex or dire a property damage claim seems, there’s a path forward when you combine knowledgeable advocacy with a determination to do right by the client.

Frequently Asked Questions (FAQs)

Q: What is the statute of limitations for property damage claims in Texas?

A: In most cases, you have two years from the date of the property damage to file a lawsuit in Texas. This applies to both real property (like your house) and personal property (like your car). Missing this deadline usually means you can’t take legal action, so mark your calendar if a claim is dragging on without resolution.

Q: My property damage insurance claim was denied – what can I do?

A: First, carefully read the denial letter to understand the reason. You can appeal or dispute the decision by providing additional evidence or pointing out errors. It’s also wise to call the adjuster (or their supervisor) and ask for clarification. If that doesn’t work, consider filing a complaint with the Texas Department of Insurance and consult an attorney. An attorney can help determine if the denial was improper under Texas law and help you challenge it through legal channels.

Q: Can I sue my insurance company for denying or underpaying my property damage claim?

A: Yes, under Texas law you can sue your insurer for breach of contract and even bad faith if they unreasonably denied or underpaid your valid claim. Before suing, Texas requires that you usually provide written notice to the insurer about your complaint (this often leads to last-minute settlements). If you do sue and prove the insurer violated the law (for example, by not attempting a fair settlement when liability was clear), you could recover not just the unpaid claim but also possibly additional damages and attorney fees. It’s best to have a property damage claims attorney assess your case to see if a lawsuit is warranted.

Q: How are property damage claims different for car accidents versus home damage?

A: The main difference is who pays and the issue of fault. For home or storm damage, you typically deal with your own homeowner’s insurance (a first-party claim) and there’s no question of fault – it’s about whether the damage is covered by the policy. For car accidents, if another driver caused the damage, you pursue their insurance (a third-party claim) and must prove fault. Also, auto policies have state minimum liability limits (e.g. at least $25,000 for property damage to others’ property), whereas home insurance payouts depend on your coverage limits. Both types of claims are subject to Texas insurance laws requiring fair and prompt handling, but the process and potential complications (like comparative fault in auto accidents) differ.

Q: When should I hire an attorney for a property damage claim?

A: If your claim is significant and you’re hitting roadblocks – such as denials, undue delays, or drastically low offers – it’s a good time to consult an attorney. Early signs like an insurer not following Texas’s required timelines, or disputing clearly documented damages, are cues that you might need legal help. Also, if the amount at stake is high (think: your home’s rebuild cost or an expensive vehicle), an attorney can ensure you’re not leaving money on the table. Basically, if you feel you’re being treated unfairly or are out of your depth with policy language and negotiation, a property damage claims attorney can step in to protect your interests.

Conclusion: Empower Yourself to Move Forward

Dealing with severe property damage in Texas is never easy, but you don’t have to face it alone or feel stuck with an unfair outcome. You have rights under Texas property damage law and options whether through the insurance process or the courts. The key is to stay informed, stay organized, and be willing to stand up for yourself. Insurance companies handle claims every day – they expect that most people will accept whatever they offer. But as you’ve learned, you can push back. Whether it’s by citing the Texas Insurance Code deadlines, getting a second opinion on repair costs, or calling in a lawyer to advocate for you, you have the power to seek the resolution you deserve. Remember, the goal is to restore what’s yours – to repair your home, to get your vehicle back on the road, and to regain peace of mind. Don’t let red tape or intimidation derail that. If the insurance path isn’t leading to a fair result, legal action might be the right path to ensure your rights are protected and your property damage is properly compensated. In the end, what matters most is getting you the help you need to rebuild and move forward. You’ve been through enough; a strong advocate (be it yourself armed with knowledge or a trusted attorney) can make all the difference in finally putting the pieces back together.

At JCE Law Group, we’re here to support you through every step—not to pressure you, but to make sure you understand your legal rights and feel confident moving forward. If you have questions, we offer a free, no-obligation consultation. Call our team today at 504-754-5884.